- Opinion

- 02 Oct 20

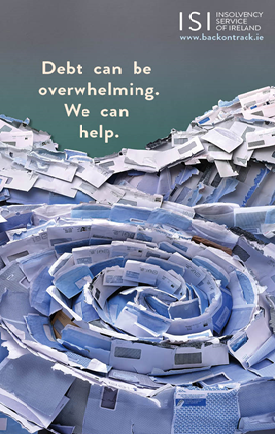

In Debt? It's Never Too Late To Get Your Finances Back On Track

Debts and financial troubles have a way of quietly piling up, so it can be difficult to identify when there is a real problem. For people who are already living month to month, it can be hard to tell the difference between getting by and genuinely struggling, but there is help.

The Insolvency Service of Ireland (ISI) is the independent government body with a range of solutions for all types and levels of debts including mortgage arrears, credit card debt, loans and overdrafts.

Often people do not realise that they have a serious debt problem; they are too busy coping with the problem and trying to make ends meet.

You could have serious debt problems if:

- You are not able to pay your bills in full when they are due

- You are paying a little off each bill trying to keep creditors (the people you owe money to) at bay

- You are reluctant to set up direct debits to pay bills in case your money cannot stretch to meet them

- You are receiving calls and letters from creditors about missed payments and threats of repossession

- You have made personal sacrifices to pay your debts

The ISI offers access to a regulated network of financial advisors (PIPs and Approved Intermediaries). Meaning they can provide you with effective help and advice from qualified professionals.

All of the debt solutions overseen by the ISI are designed to get you back on track financially, keeping you in your home where possible. At the end of the process, you will be solvent again and can start planning their future.

If you are in arrears on your home mortgage, you could also be eligible for a free PIP consultation under the state funded Abhaile service.

Of the thousands of cases that have already gone through the ISI’s systems, the majority of proposals have been accepted by creditors as it is becoming clear that it is also in the creditors’ interest to sort out any backlog of debt.

When you are worrying about debt problems, it can be tempting to ignore bills and letters from creditors and hope that the issue will go away. But the sooner you take action, the sooner you will be free of your debt and can move on with your life.

The ISI believes that you are entitled to a reasonable standard of living while you address your debt problem. If you tackle your debt using one of the ISI’s solutions, there is a minimum standard of living that you are entitled to which allows for expenses such as food, clothing, health, household goods and services, communications, socialising, education, transport, household energy, childcare, insurance and modest allowances for savings and contingencies. You can calculate your household's Reasonable Living Expenses by visiting www.backontrack.ie. The figure is often higher than the amount people in debt live on before seeking an insolvency solution.

The advice of someone who has already gone through the process is: “Don’t bury your head like I did. You need to tackle the problem and access the help that is there for you.”

For more information about the Insolvency Service of Ireland and the services they offer, visit backontrack.ie or freetext GETHELP to 50015.

RELATED

- Opinion

- 17 Dec 25

The Year in Culture: That's Entertainment (And Politics)

- Opinion

- 16 Dec 25

The Irish language's rising profile: More than the cúpla focal?

- Opinion

- 13 Dec 25